Navigating Automotive Loan Repossession

Dhiman Bhattacharjee

CEO & Co-founder, Finexus Inc.

6 Min Read

11 Dec 2023

Introduction

Automotive or auto loans have revolutionized how people access vehicles, making car ownership dreams more attainable. These loans empower individuals to acquire vehicles, using them as collateral. Yet, a shadow occasionally looms over this financial sunshine: the possibility of vehicle repossession. When borrowers encounter difficulties in meeting their payment obligations, lenders may have to initiate the process of repossession to recover their investment. In this blog, we’ll take you on a journey through the world of auto loan collections, shedding light on the intriguing process of repossession, the legal intricacies, and the strategies lenders employ to navigate this challenging terrain.

Auto Loan Delinquency

Delinquency rates of auto loans 60+ days past due (DPD) have risen 26 basis points from Q1 2021’s 1.43% to 1.69% in Q1 2023, according to a recent Credit Industry Insight Report (CIIR) by TransUnion. (TransUnion, 2023). The spike in delinquencies is not impacting a large slice of lenders doing near-prime, prime, or prime-plus loans. The burden of the delinquencies is felt by the independent lenders who operate in the sub–prime space and primarily lend for used-vehicle purchases. Prime borrowers have excellent credit, and near-prime borrowers have slightly less favorable credit profiles. However, they still need to be considered relatively low risk; prime-plus borrowers fall between prime and near-prime with good but not excellent credit. In contrast, sub-prime borrowers pose higher credit risks due to a history of financial challenges. According to the American Association of Motor Vehicle Administrators (AAMVA), in 2020, around 2.39% of all outstanding auto loans in the United States ended in repossession (National Motor Vehicle Title Information System, 2022). This statistic underscores the prevalence of repossessions and their impact on borrowers and lenders alike.

Delinquency rates of auto loans 60+ days past due (DPD) have risen 26 basis points from Q1 2021’s 1.43% to 1.69% in Q1 2023, according to a recent Credit Industry Insight Report (CIIR) by TransUnion. (TransUnion, 2023). The spike in delinquencies is not impacting a large slice of lenders doing near-prime, prime, or prime-plus loans. The burden of the delinquencies is felt by the independent lenders who operate in the sub-prime space and primarily lend for used-vehicle purchases. Prime borrowers have excellent credit, and near-prime borrowers have slightly less favorable credit profiles. However, they still need to be considered relatively low risk; prime-plus borrowers fall between prime and near-prime with good but not excellent credit. In contrast, sub-prime borrowers pose higher credit risks due to a history of financial challenges. According to the American Association of Motor Vehicle Administrators (AAMVA), in 2020, around 2.39% of all outstanding auto loans in the United States ended in repossession (National Motor Vehicle Title Information System, 2022). This statistic underscores the prevalence of repossessions and their impact on borrowers and lenders alike.

Auto Loan Repossession

Repossession represents the final recourse for a lender in its collection endeavors, typically undertaken only when all other attempts to retrieve payments have failed. Lenders exhaust a series of proactive measures, including reminders, negotiation, and loan restructuring, before resorting to repossession. This last resort underscores the gravity and significance of the decision to repossess collateral, reflecting the lender’s commitment to exhausting all reasonable avenues before taking such drastic action.

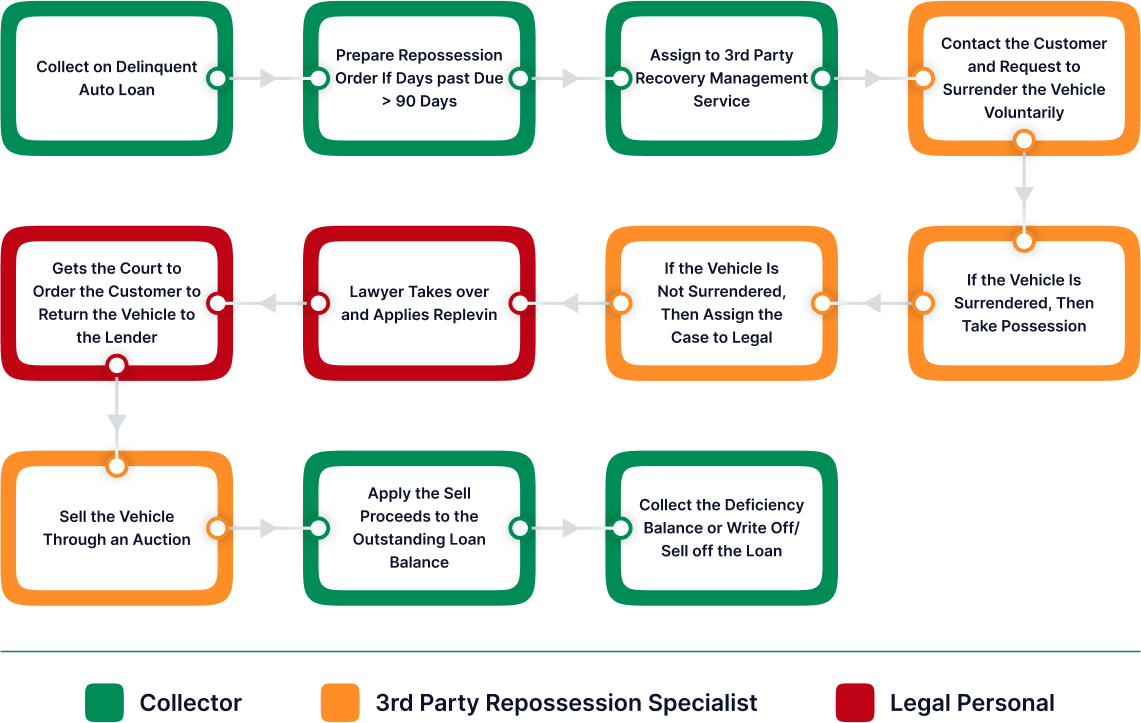

The Repossession Process:

Repossession typically involves several parties, including the lender, a collector, a third-party repossession agency, and potentially a lawyer. The steps in the repossession process can vary based on local laws and the terms outlined in the loan agreement. Here’s a sample of these entities’ roles in the repossession process. Please refer to Figure 1 for a typical repossession process flow diagram.

1. Lender

- The lender or creditor is the entity that provided the loan or financed the purchase of the property. When the borrower defaults on payments, the lender initiates repossession to recover the outstanding debt.

2. Collector

- A collector is often an employee of the lender who manages the early stages of the delinquency. The collector’s role is to contact the borrower when they miss payments, remind them of their financial obligations, and attempt to negotiate a resolution. Collectors may work for the lender directly or be employed by a separate collection agency.

3. Third-Party Repossession Agency

- In cases where the borrower fails to make payments despite collection efforts, the lender may hire a third-party repossession agency. This agency specializes in locating and recovering the property on behalf of the lender. Repossession agents from this agency are responsible for physically reclaiming the vehicle once authorized by the lender.

- The third-party repossession agency typically follows the legal process for repossession in the jurisdiction where the borrower resides. This involves adhering to notification requirements, obtaining necessary court orders, and ensuring the repossession is conducted without breaching the peace.

- Once the vehicle is repossessed, it is usually stored by the repossession agency until the lender decides to sell the vehicle to recover the outstanding debt.

3. Lawyer

- Legal replevin is a court-authorized process that enables a lender, to lawfully reclaim possession of a vehicle when the borrower has defaulted on a loan or breached a contractual agreement. This legal action involves obtaining a court order, known as a writ of replevin, to recover the vehicle, ensuring compliance with relevant legal procedures, and protecting the rights of all involved parties. Lawyers get involved in the replevin process, particularly when legal actions are required to repossess the vehicle. The lender’s legal team may initiate a replevin lawsuit to obtain a court order allowing the repossession of the vehicle.

- Lawyers also help ensure the repossession process complies with all relevant laws and regulations. They may advise the lender and the third-party repossession agency, guiding them through the necessary legal steps.

The Role of Technology and Loan Debt Collection Software Solutions

The rise in delinquency rates underscores the need for innovative approaches to mitigate risks and navigate the complexities of the repossession process. One avenue gaining prominence in this context is the role of technology, particularly loan debt collection software solutions.

Technology plays a pivotal role in enhancing the efficiency of auto loan collections, especially during the repossession phase. Leveraging advanced software solutions can streamline processes, improve communication, and provide valuable insights to lenders and collection agencies.

Loan Debt Collection Solution Features to Support the Repossession Process

To effectively facilitate the repossession process, an optimal collection solution should include the following features:

- Digital Repo Orders: The solution should support creating and managing electronic repo orders and authorizations. This will support working with 3rd party repo services and legal services.

- Two-way Communication with Repo Agents: The collection system should enable two-way communication with repo agents in the field. This ensures that repo agents receive real-time updates and instructions and can report back on the status of repossession attempts.

- Real-Time Location Tracking: This is a nice-to-have feature. Integrating with geo-location services allows the solution to track the vehicle’s location in real-time. This can be especially valuable for repossession agents in locating and recovering assets.

- Automated License Plate Recognition (ALPR) Integration: Integration with ALPR technology can aid in identifying and tracking vehicles, expediting the repossession process, and reducing the margin for error.

- Case Integration: Integration with a case management system can ensure a seamless transition from collector to repossession agent to legal representative, streamlining the workflow for all professionals involved.

- Legal Case Management: For replevin actions or legal proceedings, the solution should support case tracking, court date management, and the ability to store legal documents.

- Dynamic Skip Tracing Tools: Integration with enhanced skip tracing services within the solution can help locate borrowers who have intentionally avoided repossession, improving the chances of successful recovery.

- Alerts for Compliance Deadlines: Providing customizable alerts and notifications that remind users of critical compliance deadlines ensures that legal and regulatory requirements are met.

- Integration with Auction Platforms: This is a nice-to-have feature. For recovered vehicles that need to be sold, integration with online auction platforms can facilitate the quick and efficient sale of repossessed items.

- Unified Customer Profiles: A centralized view of customer information, including payment history, communication history, and previous repossession attempts, can provide a comprehensive understanding of the borrower’s situation.

- Performance Analytics: The system should provide advanced analytics tools to help assess collectors’ and repo agents’ performance, identify trends, and optimize repossession strategies based on historical data.

Effectively managing auto loans is a multifaceted process that requires a strategic approach, a keen understanding of legal and compliance considerations, and the right technology solution. Implementing the right collection software solution can significantly enhance the efficiency of the repossession process. With Finexus Inc.’s FX Collections, lenders and collection agencies can easily navigate the challenges of collections in auto loans, particularly repossession, stay compliant with regulations, and improve overall success rates in recovering assets.

Implementing an FX Collections solution with features such as out-of-the-box repo process workflow, digital repo orders, two-way communication with repo agents, and legal workflows can significantly enhance the efficiency of the repossession process. Ensuring seamless integration with skip-tracing tools and auction platforms further contributes to a comprehensive and streamlined approach. As the financial landscape evolves, continuous adaptation, data-driven insights, and a commitment to customer communication are vital for maintaining effective collections practices in the dynamic realm of auto loans.

Frequently Asked Questions

1. Can I Get an Auto Loan with Repossession on My Credit?

While obtaining an auto loan with a repossession on your credit may be challenging, some lenders specialize in working with individuals with less-than-perfect credit. Expect higher interest rates and stricter terms in such cases.

2. How Long Does a Repossession Stay on My Credit?

A repossession typically stays on your credit report for up to seven years from the date of the first missed payment that led to the repossession.

3. How Can I Improve My Credit after Repossession?

To improve your credit after repossession, focus on timely payments, reducing outstanding debt, and diversifying your credit mix. Consider obtaining a secured credit card and maintaining responsible credit practices.

4. Can a Charged-off Auto Loan Be Repossessed?

A charged-off auto loan means the lender considers the debt unlikely to be collected. While the debt is charged off, the vehicle may still be repossessed if the lender has not yet recovered it.

5. How Does an Auto Loan Charge off Without Repossession Work?

In some cases, a lender may charge off the auto loan without repossession if they believe the cost of repossession outweighs the potential recovery. The debt remains, and the lender may pursue other means, such as collections or legal action, to recover the outstanding amount.

Disclaimer

The responses provided in this FAQ section are intended to offer general information and insights into common queries related to auto loan repossession. It’s crucial to emphasize that individual financial situations can vary significantly, and the information provided should not be considered as personalized advice or a one-size-fits-all solution.

References

[1] Credit Card and Unsecured Personal Loan Balances Remain at or Near-Record Levels as Consumers Navigate Challenging Economic Climate – Q1 2023 TransUnion Credit Industry Insights Report explores latest credit trends, https://newsroom.transunion.com/q1-2023-ciir/

[2] American Association of Motor Vehicle Administrators (AAMVA), “Vehicle Finance Trends: Market Insights 2021,” https://www.aamva.org/Resource-Center/Market-Trends/

[3] Federal Reserve Bank of New York, “Quarterly Report on Household Debt and Credit,” 2021, https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2021Q4.pdf

[4] Consumer Financial Protection Bureau (CFPB), “Auto Loan Servicing and Collateral Recovery,” https://files.consumerfinance.gov/f/documents/201702_cfpb_Collateral-Recovery-Discussion-Guide.pdf

[5] National Conference of State Legislatures, “Motor Vehicle Finance and Repossession,” https://www.ncsl.org/research/financial-services-and-commerce/motor-vehicle-finance-and-repossession.aspx

[6] National Automobile Dealers Association (NADA), “Repossession and Remarketing,” https://www.nada.org/NR/rdonlyres/045FF4CB-05E0-4C88-91C8-7D135F51031E/0/NADAResolution0516RepossessionandRemarketing05182016.pdf

[7] Federal Trade Commission (FTC), “Repo’s, Abuses, and Your Rights,” https://www.consumer.ftc.gov/articles/repossession-what-consumers-need-know

[8] Federal Trade Commission (FTC), “Understanding Vehicle Repossession,” https://www.consumer.ftc.gov/articles/0144-vehicle-repossession

Leave a comment below

let’s talk

Ready to Elevate Your Lending Business?

Contact us today to discuss your needs, request a demo, or get answers to your questions.

Let's work together to achieve your lending business goals.

© 2023 Finexus Inc. All Rights Reserved.